Pool Service Report: Adapting to Change

Skimmer’s 2025 State of Pool Service report details industry challenges and opportunities

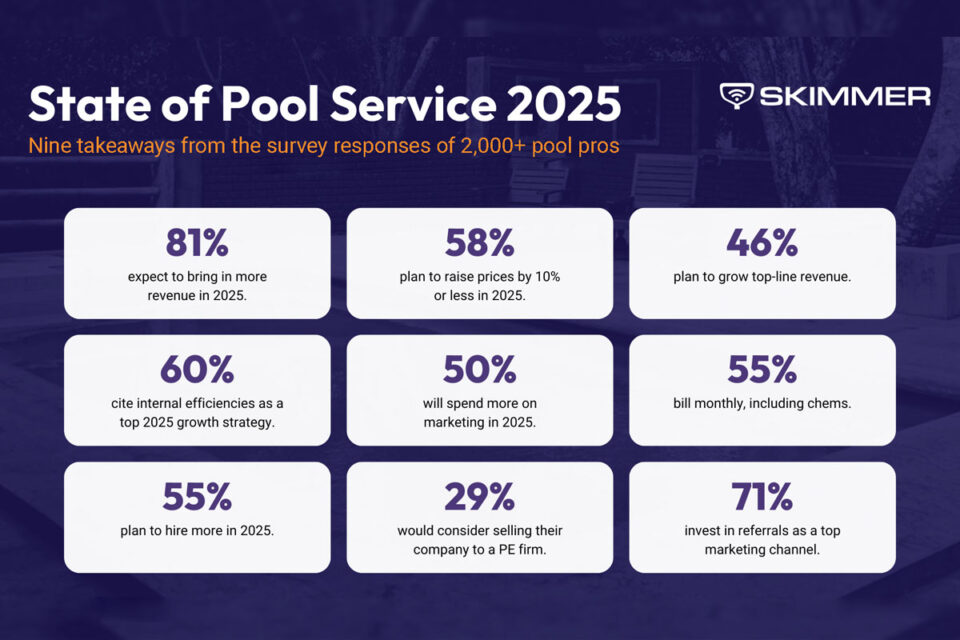

The pool service industry is navigating economic uncertainty as it moves into 2025, but professionals remain confident they can adapt and thrive. Inflation and labor shortages were top concerns in 2024, according to Skimmer’s 2025 State of Pool Service report. However, pool pros are meeting these obstacles with strategic pricing adjustments, smarter business structures and a growing focus on technology.

Takeaways from the report

- Economic pressures are here to stay. In 2024, rising costs for materials, chemicals and labor put pressure on pool service businesses, a trend expected to continue in 2025. Many pros are implementing moderate price increases to offset these costs while maintaining high-quality service.

- Growth strategies are becoming more sophisticated. Pool companies are moving beyond traditional growth tactics, exploring new revenue streams, investing in employee training and leveraging technology to drive efficiency. The industry is maturing, and businesses that embrace data-driven decision-making are positioning themselves for long-term success.

- Private equity: A double-edged sword. The increasing presence of private equity in the pool industry has sparked mixed reactions. While some see opportunities for expansion, others worry about a loss of autonomy and the potential for declining service quality.

- Marketing strategies are evolving. The days of relying on buying leads from lead suppliers are fading. Instead, pool pros are prioritizing customer engagement, online presence and targeted outreach to attract and retain clients.

- Pricing models remain a challenge. Despite rising chemical costs, many pool service businesses have yet to fully adopt a plus-chems pricing model because of concerns about customer pushback and industry-wide adoption rates.

How pool pros are budgeting in 2025

The report highlights a shift in spending priorities:

- 35% of budgets are going toward people-related expenses, up from 34% in 2024.

- 33% is dedicated to maintenance costs, including chemicals and equipment, down from 35% in 2024.

- 10% of spending is focused on marketing, up from 7% last year.

- Software and technology investments have declined to 8%, a drop from 12% in 2024.

- Office-related expenses — rent, building overhead, etc. — round out the rest of the budget at 14%, up from 12% in 2024.

Opportunities and challenges in 2025

Rising consumer spending and increased demand from property managers, hotels and new pool construction offer growth opportunities, but price-based competition, automation and volatile chemical costs remain key challenges.

How pool pros can stay competitive

The report outlines three key strategies for success:

- Adopt proactive pricing. Adjust rates transparently while communicating the value of services.

- Expand your skills. Invest in training and certifications to stay ahead of industry trends.

- Enhance customer experience. Strong client relationships are the key to retention and growth.

Final outlook

Despite economic uncertainty, Skimmer’s report paints a picture of an industry evolving and modernizing.

“The demand for reliable, skilled pool service has never been higher, fueled by the growing number of pool owners who see their spaces as essential for connection, relaxation and wellness,” says Jack Nelson, CEO of Skimmer. “Alongside this, the expectations for efficiency and professionalism in the industry have risen, creating both challenges and exciting opportunities for all of us.”

With the right mix of technology, smart pricing and strategic partnerships, pool pros can overcome obstacles and thrive in the year ahead.