Busy But Broke

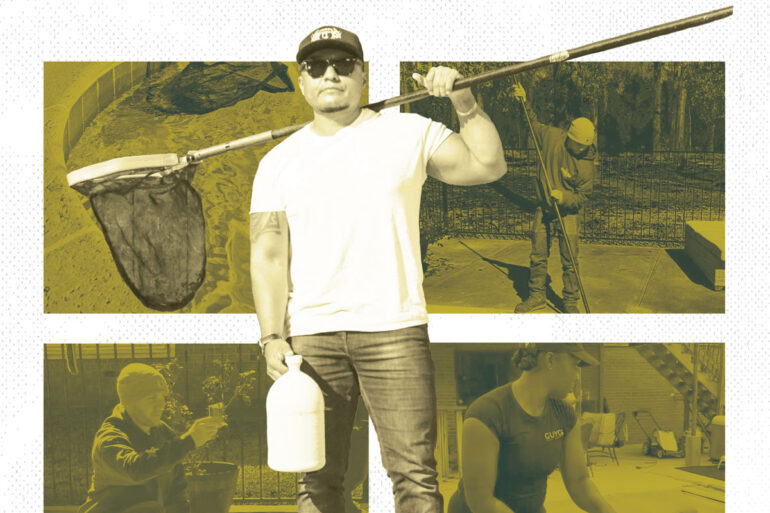

I remember how excited Ronnie was. He called me two years ago to say he had just been awarded his largest — by far — pool contract. A single pool he priced at over $260,000. That’s a lot in our market. I was concerned because the price was almost two and a half times his previous high bid. But he assured me he priced the job with adequate margins (30% or $78,000). The contract was signed, and he was going to do it.

It turns out my concerns were justified. The job dragged out for over four months for myriad reasons — cash, equipment, labor, subs. The customer paid the full amount, and Ronnie made his margin, but four months of overhead completely wiped out any sniff of net profit.

Ronnie’s lesson was clear: Winning a bid doesn’t mean you will make money on the job, even if you price it with healthy margins. If the job takes too long, profit disappears, and fast.

I often hear contractors talk about the nice profit they made on a job. I understand what they are getting at, but what they really mean is they made a nice margin on a job. Margins are not profit. Your ability to earn a consistent profit depends on understanding the difference between the two.

Margin vs. profit: What’s the difference?

Many contractors confuse margin and profit.

Margin is what remains from the selling price after paying all variable costs, also known as direct costs, such as materials and labor.

Profit is what’s left after all expenses — both variable costs and overhead costs — have been paid.

So, while we might brag about the great margins, we can’t boast about profit until we have earned enough of a margin to pay our overhead expenses.

Contractors know their bid price needs to cover material and labor, but when it comes to adding margin to cover overhead and profit, they tend to rely on “what the competition is charging” rather than what they actually need to break even and make a profit.

Overhead is hard to allocate to jobs because it is not directly associated with one job; it is a function of time. So how can we determine the margin we need to hit our goals? By using our capacity to tell us.

Overhead and capacity

Overhead refers to regular, recurring expenses necessary to keep the business running, such as:

- Rent

- Insurance

- Office salaries

- Utilities

These costs recur every month whether or not you have work.

Capacity refers to the maximum amount of work (in dollars) your business can complete in a given time. If your team can only handle $400,000 of work per month, but you price jobs as if you can do $600,000, you won’t meet your profit target because the extra work will spill into the next month — and increase the overhead the job must cover.

The impact of overhead and capacity on bidding

To see how it works, let’s assume your business has a monthly overhead of $100,000 and you have a target profit of $20,000 each month. This means your bid(s) for the month have to generate at least a $120,000 margin to hit your goals. If you estimate your capacity to be $400,000 of work per month, you have to bid jobs with a 30% margin (minimum) to have even a chance of hitting your goals.

Formula:

(Overhead costs + Target profit) ÷ Monthly capacity x 100 = Target margin %

Example:

$120,000 ÷ $400,000 x 100 = 30%

How time eats profit

Overhead expenses are time charges — so many dollars per month. As the time required to complete a job increases, so does the amount of overhead. Suppose you take on that $400,000 job expecting to complete it in one month. With your 30% margin, the job should contribute $120,000. But what happens if the job takes two months instead of one?

| Scenario | Revenue | Margin | Overhead | Net Result |

| Job Takes 1 month | $400,000 | $120,000 | $100,000 | $20,000 profit |

| Job Takes 2 months | $400,000 | $120,000 | $200,000 | -$80,000 loss |

Instead of a $20,000 profit, you’re $80,000 in the hole. Because the job took longer than planned, it did not generate enough margin to pay the extra overhead.

The lesson? Your capacity affects profit as much or even more than price does.

How to bid to cover overhead and protect profits

Here’s how to ensure you have a good estimate of how much margin you need to pay your overhead and earn a target profit.

- Know your company’s target margin.

As we saw above:

Estimate the amount of work you can do in a month. This is your best estimate of your capacity. In our example, capacity is $400,000

Decide a target gross profit for the month. In this example, the target gross profit has to be enough to pay $100,000 of overhead and $20,000 of net profit, for a total of $120,000

Calculate your minimum target margin as a percentage of your bid price:

Formula:

(Overhead costs + Target profit) ÷ Monthly capacity x 100 = Target margin %

Example:

$120,000 ÷ $400,000 x 100 = 30%

- Adjust for uncertain timelines.

If a job requires less than your total capacity, you still need to bid at your minimum target margin percentage (or higher). If a project has an uncertain timeline, increase your margin to account for likely delays and extended overhead costs. - Know your capacity and plan accordingly.

Bidding below your target margin almost certainly guarantees that you won’t be able to cover costs or make a net profit. - Regularly review overhead costs

Monthly overhead varies (usually increasing) over time. Be sure you are estimating based on current information.

Bid with clarity and confidence

As Ronnie learned, avoid the “busy but broke” trap. You don’t need the work; you need profitable work. (That pays on time!) Bidding without understanding your margins leads to bidding on the cheap, which leads to losses, which leads to your being broke. As a former client of mine said, “I can go broke on the beach.” Know your numbers and bid for profit.